What Are Cryptocurrency Exchanges Doing With Your Money

What are Cryptocurrency Exchanges?

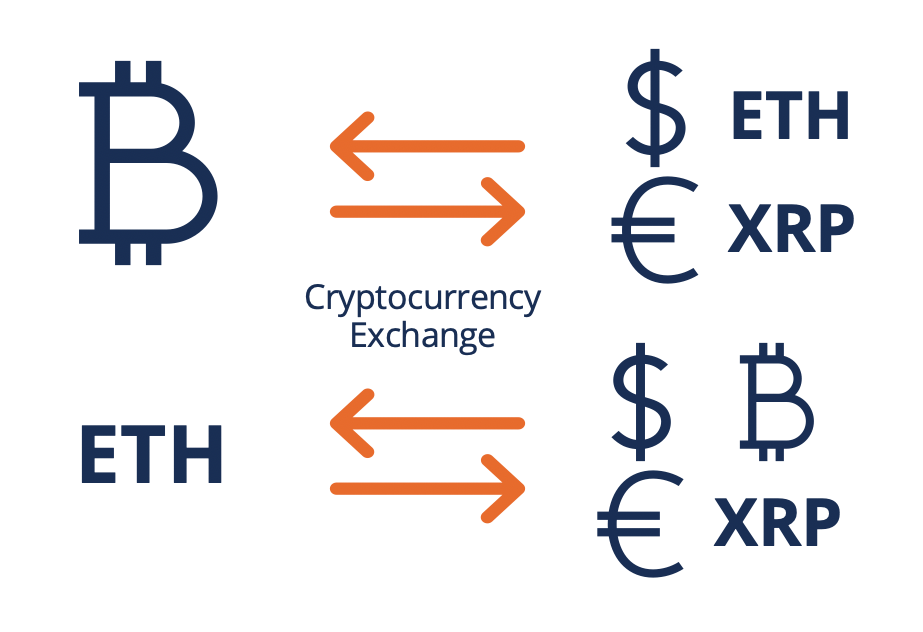

Cryptocurrency exchanges are platforms that facilitate the trading of cryptocurrencies for other avails, including digital and fiat currencies. In effect, cryptocurrency exchanges human action equally an intermediary between a heir-apparent and a seller and make coin through commissions and transaction fees.

On mutual cryptocurrency exchanges, $100 tin can exist exchanged for bitcoin of equivalent value, and vice-versa. Similarly, bitcoin worth $100 tin be exchanged for Ethereum of equivalent value. The same concept can exist practical to dissimilar assets based on what is offered by the exchange.

Centralized vs. Decentralized Cryptocurrency Exchanges

Centralized cryptocurrency exchanges act as a third-party between a heir-apparent and a seller. Since they are operated and controlled past a company, centralized exchanges offer more reliability. Approximately 99% of all crypto transactions go through centralized exchanges. Examples of centralized cryptocurrency exchanges include:

- Coinbase

- GDAX

- Kraken

- Gemini

Decentralized cryptocurrency exchanges (DEX) allow users to execute peer-to-peer transactions without the demand for a third political party or an intermediary. Due to some of the bug associated with centralized exchanges, decentralized exchanges are preferred by some users.

Still, decentralized exchanges exercise not facilitate the trading of fiat currencies for cryptocurrencies. Examples of decentralized cryptocurrency exchanges include:

- AirSwap

- io

- Barterdex

- Blocknet

Advantages of Centralized Cryptocurrency Exchanges

1. User-friendly

Centralized exchanges offer beginner investors a familiar, friendly style of trading and investing in cryptocurrencies. As opposed to using crypto wallets and peer-to-peer transactions, which can be complex, users of centralized exchanges can log into their accounts, view their account balances , and make transactions through applications and websites.

2. Reliable

Centralized exchanges offer an extra layer of security and reliability when information technology comes to transactions and trading. Past facilitating the transaction through a adult, centralized platform, centralized exchanges offering higher levels of condolement.

Disadvantages of Centralized Cryptocurrency Exchanges

1. Hacking risk

Centralized exchanges are operated by companies that are responsible for the holdings of their customers. Big exchanges usually hold billions of dollars worth of bitcoin, making them a target for hackers and theft.

An example of such an incident is Mt.Gox, which was once the world's largest cryptocurrency exchange company earlier information technology reported the theft of 850,000 bitcoins, leading to its suspension.

2. Transaction fees

Unlike peer-to-peer transactions, centralized exchanges ofttimes charge high transaction fees for their services and convenience, which can be peculiarly loftier when trading in large amounts.

Advantages of Decentralized Cryptocurrency Exchanges

1. Mitigating hacking take a chance

Users of decentralized exchanges exercise not need to transfer their assets to a tertiary political party. Therefore, there is no risk of a visitor or arrangement beingness hacked, and users are assured of greater safety from hacking and theft.

2. Preventing market manipulation

Due to their nature of assuasive for the peer-to-peer exchange of cryptocurrencies, decentralized exchanges forbid market manipulation, protecting users from fake trading and wash trading .

3. Anonymity

Decentralized exchanges do not require customers to fill out know-your-customer (KYC) forms, offering privacy and anonymity to users.

Disadvantages of Decentralized Cryptocurrency Exchanges

1. Complication

Users of decentralized exchanges must recollect the keys and passwords to their crypto wallets, or their avails are lost forever and cannot be recovered. They require the user to learn and get familiar with the platform and the process, unlike centralized exchanges, which offer a more than convenient and user-friendly procedure.

two. Lack of fiat payments

Decentralized exchanges do non allow for the trading of fiat currencies for digital ones, making them less convenient for users that exercise non already concord cryptocurrencies.

3. Liquidity struggles

Some 99% of crypto transactions are facilitated past centralized exchanges, which suggests that they are answerable for the majority of the trading book . Due to the lack of book, decentralized exchanges often lack liquidity, and information technology tin be difficult to find buyers and sellers when trading volumes are depression.

The 10 Best Cryptocurrency Exchanges, Ranked past Volume

Top Centralized Exchanges

The following are the superlative centralized cryptocurrency exchanges, according to traffic, liquidity, and trading volumes.

- Binance

- Huobi Global

- Coinbase (Pro)

- Kraken

- Bithumb

- Bitfinex

- Bitstamp

- KuCoin

- FTX

- bitFlyer

Top Decentralized Exchanges

Below are the highest-ranked decentralized cryptocurrency exchanges, according to traffic, liquidity, and trading volumes:

- Uniswap (V2)

- Tokenlon

- 0x Protocol

- Venus

- Sushiswap

- Compound

- BurgerSwap

- Bend Finance

- 1inch Commutation

- PancakeSwap

More Resources

Give thanks yous for reading CFI's guide to Cryptocurrency Exchanges. To go along advancing your career, the additional CFI resources below will be useful:

- Introduction to Cryptocurrency Grade

- Bitcoin Mining

- Fiat Money

- Transaction Costs

- Virtual Currency

Source: https://corporatefinanceinstitute.com/resources/knowledge/other/cryptocurrency-exchanges/

Posted by: langbeglas.blogspot.com

0 Response to "What Are Cryptocurrency Exchanges Doing With Your Money"

Post a Comment